The Only Guide for Affordable Care Act (Aca) In Toccoa, Ga

Table of ContentsThe Buzz on Life Insurance In Toccoa, GaInsurance In Toccoa, Ga for BeginnersNot known Factual Statements About Insurance In Toccoa, Ga Not known Facts About Home Owners Insurance In Toccoa, GaSome Known Questions About Life Insurance In Toccoa, Ga.The Buzz on Life Insurance In Toccoa, Ga

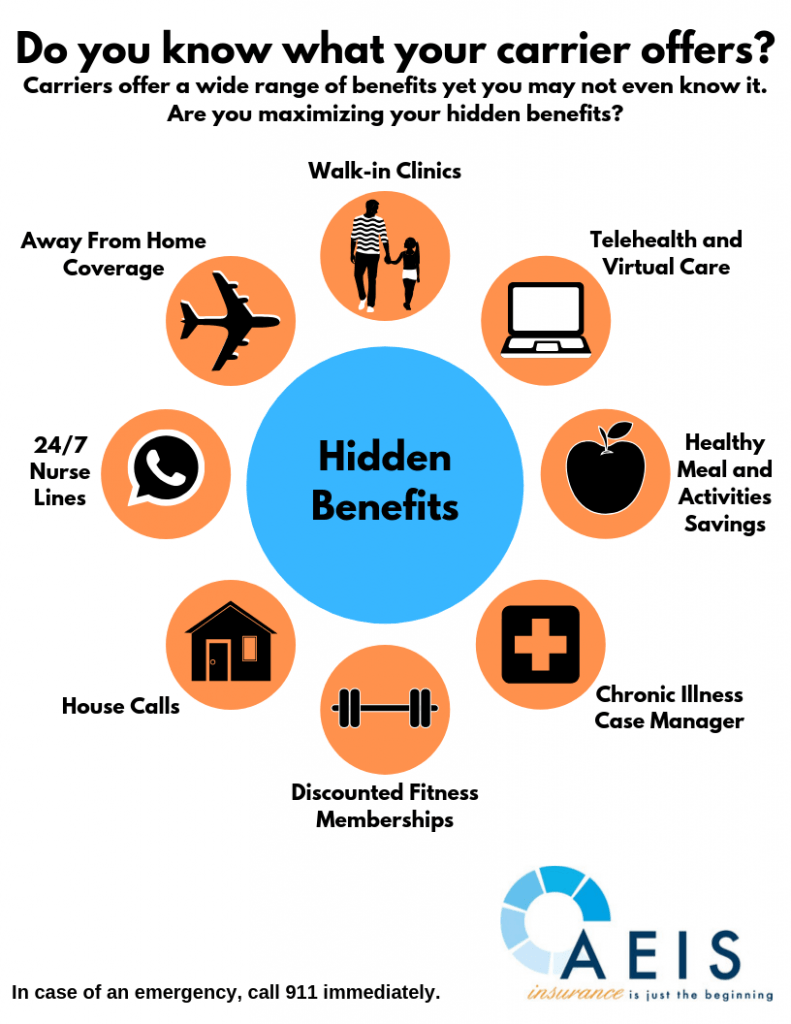

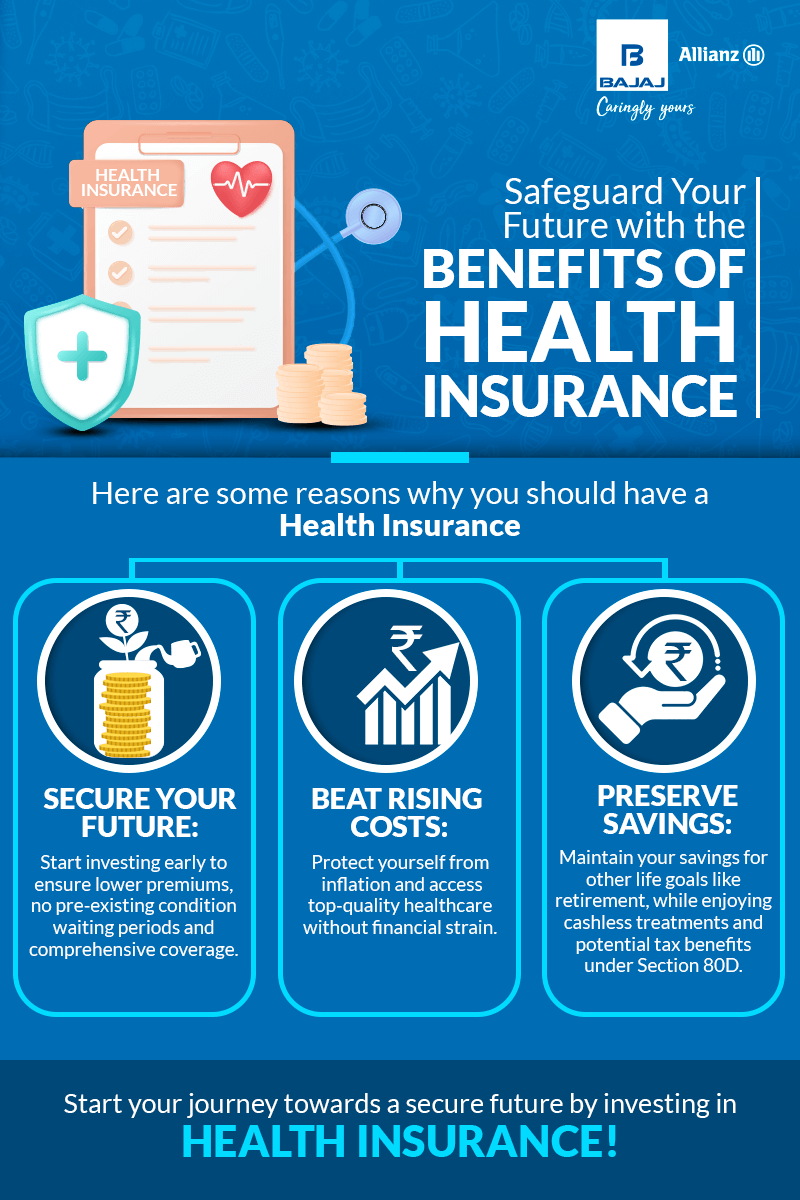

See if you are qualified to use the Wellness Insurance policy Industry. To be eligible to register in wellness protection through the Industry, you: Under the Affordable Care Act(ACA), you have unique individual protection when you are guaranteed through the Wellness Insurance Coverage Marketplace: Insurers can not decline coverage based on sex or a pre-existing condition. Some civil liberties and protections use to plans in the Wellness Insurance Coverage Industry or other specific insurance coverage, some use to job-based plans, and some use to all health insurance coverage.With clinical costs soaring, the requirement for exclusive health insurance policy in this day and age is a financial truth for several. Within the category of personal

health wellnessInsurance policy there are significant substantial distinctions a health health and wellness took care of CompanyHMO)and a preferred provider copyright(PPO)plan. Of program, the most noticeable advantage is that personal health and wellness insurance can supply insurance coverage for some of your medical care expenditures.

Getting My Annuities In Toccoa, Ga To Work

Many specific plans can cost numerous hundred bucks a month, and family members coverage can be also greater. And even the much more thorough plans included deductibles and copays that insureds have to meet before their protection starts.

The majority of wellness strategies need to cover a collection of preventative services like shots and screening tests at no cost to you. https://parkbench.com/directory/thomas-insurance-advisors. This consists of plans available via the Health and wellness Insurance Coverage Marketplace.

The Only Guide to Annuities In Toccoa, Ga

When you buy insurance, the monthly costs from your insurance provider is called a costs. Insurance provider can no longer bill you a higher premium based upon your health condition or as a result of pre-existing clinical conditions. Insurance provider providing significant medical/comprehensive plans, set a base rate for everybody that buys a health and wellness insurance policy strategy and then change that price based upon the elements detailed below.

Normally, there is a tradeoff in the costs amount and the expenses you pay when you obtain care. The higher the regular monthly costs, the lower the out-of-pocket expenses when you obtain treatment.

To learn more on kinds of medical insurance, call your employer advantage representative or your financial expert. In summary, right here are a few of the benefits and drawbacks of making use of exclusive medical insurance. Pros Multiple choices so you can select the very best strategy to satisfy your specific demands Typically uses higher versatility and access to care than public health insurance coverage Can cover the expense of expensive medical care that might arise unexpectedly Cons Expensive with costs increasing every year Does not guarantee complete access to care If you would certainly such as to discover more about conserving for healthcare or just how medical care can affect your household budget plan, explore the Protective Knowing.

What Does Final Expense In Toccoa, Ga Do?

Many health insurance must cover a collection of precautionary services like shots and screening tests at no charge to you. This consists of strategies offered through the Medical insurance Marketplace. Notification: These services are totally free only when delivered by a medical professional or various other copyright in your strategy's network. There are 3 sets of free preventive services.

When you get insurance coverage, the month-to-month costs from your insurance policy firm is called a premium. Insurance provider can no more bill you a greater premium based upon your wellness status or due to pre-existing medical problems. Insurer using major medical/comprehensive policies, set a base rate for everyone that gets a wellness insurance strategy and then readjust that rate based upon the aspects listed below.

Normally, there is a tradeoff in the costs amount and the expenses you pay when you obtain care. The higher the month-to-month premium, the lower the out-of-pocket expenses when you obtain care.

Some Known Details About Home Owners Insurance In Toccoa, Ga

A lot of health insurance plan have to cover a set of preventative services like shots and testing tests at no expense to you. This consists of strategies available with the Medical insurance Marketplace. Notice: These services are cost-free only when provided by a medical professional or other supplier in your plan's network. There are 3 sets of cost-free preventive services.

When you purchase insurance coverage, the regular monthly expense from your insurance coverage business is called a premium. Insurer can no more bill you a greater costs based upon your health and wellness status or because of pre-existing clinical problems. Insurance provider offering significant medical/comprehensive policies, established a base rate for everyone that purchases a medical insurance plan and then readjust reference that rate based upon the aspects noted below.

The smart Trick of Insurance In Toccoa, Ga That Nobody is Talking About

Typically, there is a tradeoff in the premium amount and the costs you pay when you receive care - Automobile Insurance in Toccoa, GA. The higher the monthly premium, the reduced the out-of-pocket prices when you obtain treatment

Comments on “Facts About Final Expense In Toccoa, Ga Uncovered”